Technology Manifest Destiny

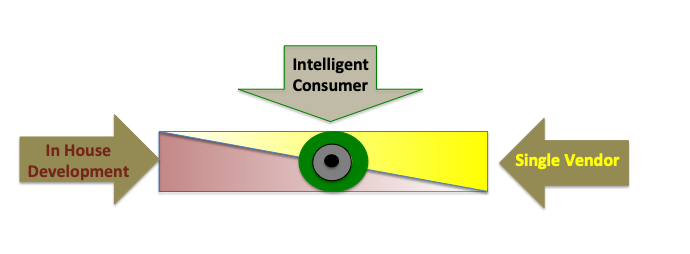

To manage their destiny, CSPs need to become intelligent consumers of infrastructure software. As telcos and other communications service providers move into software-centric networks, they face a key decision. Some are focused on buying all their key software from one or two large vendors. Others are choosing to focus on developing their own key software internally. Both of these approaches are fraught with danger, including the concerns of innovation, differentiation, reskilling, and cost control. As shown in Figure 1 below, the smartest path lies in the middle on the spectrum of choices between these two extremes. This middle path is best described as becoming an intelligent consumer.

Software as destiny

In a softwarized network, a CSP is essentially the sum of its infrastructure software. Innovative, high-quality, easy-to-maintain software makes for a thriving telco. Missing out on any one of these risks becoming moribund.

Single vendor extreme

Let’s go through a scenario to illustrate this concept. Telco A is going through a management change and has revised its strategic plan. One area that its plan addressed is infrastructure

software technology sourcing. Leadership has decided to partner with one very large software vendor. Theoretically, this allows Telco A to remain technically current while taking advantage of

economies of scale, thus lowering costs. Further cost containment would come from avoiding a major reskilling effort and even reducing headcount. This also simplifies work for the procurement

department.

Figure 1: Finding the middle between internal development and single vendor procurement

The Telco A approach reminds me of a situation at Visa some decades ago. Once a year, the IBM sales rep for Visa would bring a binder to the head of technology. It had the complete systems plan for the next year: every product necessary, including hardware, software, service, documentation, training and so forth. The head of technology would take the binder as his budget to his CEO. Visa’s only product primarily existed in its computer system. The strength of the connection between IBM and Visa’s destiny became clear when the CEO retired and the IBM sales rep took his place.

The situation between Telco A and its supplier may not be as extreme, but the Visa case is illustrative. When a company is captive to one supplier, the company may gain benefits but faces the risks consistent with buying from a monopoly, including higher prices, lower quality, and loss of the ability to innovate. This loss means ending up with the lowest common denominator functionality, which leads to loss of differentiation of Telco A’s services from its competitors.